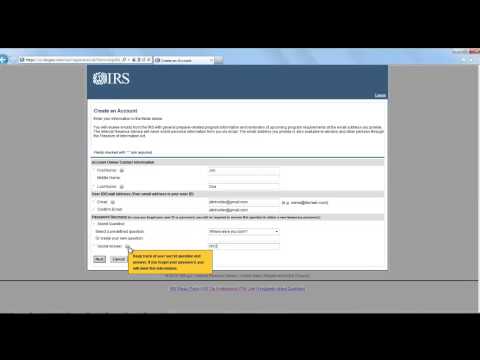

To apply for a tax identification number or PTIN, the first thing you must do is create an online account. Just go to irs.gov/peatn and select "Renew" or "Sign up now" from the left-hand side of the screen. Once you are on the login page, select "Create an Online PTIN Account". Next, type in the information needed to create your account. The fields with a red asterisk are mandatory and include your first and last name. Use the same name as shown on your previous year's tax return. Include an email address and use one that you can access all year. Remember, this email address will also be your user ID. You'll also need to include a secret question and a secret answer. You may notice question marks next to some fields. You can move your mouse over these to see helpful tips. Be sure to keep track of your user ID and secret answer, as you may need these if you forget your password in the future. After completing the fields, click "Next", then review your information and click "Submit". After you submit your information, a temporary password will be emailed to you. You can find it in the in of your email. You may need to check your spam or junk folder. Now, return to the PTIN system login page. Enter your user ID, which is your email address, and then enter the temporary password that was emailed to you. To do this, simply highlight the password, right-click your mouse or select "Edit" on your toolbar, then select the "Copy" function, and paste the temporary password in the password field on the login page. You should now see a redacted copy of the temporary password, and you can click the "Sign in" button. At this point, the system...

Award-winning PDF software

Ptin Application Form: What You Should Know

PAIN with a new e-file or telephone application By e-file: If you apply (mail or fax) in person you will not have to fill out tax return information. When you mail your PAIN form to IRS, you will not have to send the tax return portion of the form (or e-return claim form) to IRS. Taxpayers can download Form W-12 and submit the same application at any IRS address. By Telephone: For taxpayers that wish to submit a PAIN for telephone tax preparation, visit your local telephone or online IRS center. You may choose to go online to complete your Form 8821. Then use an agent to complete the telephone tax application process and submit it to IRS. Taxpayers seeking to avoid the filing of a PAIN and apply for a prepaid debit card or prepaid card may also choose to pay by debit or credit card at the time the phone or online PAIR is initiated. Taxpayers can also pay at a Post Office location by making a paper tax return with a valid tax return address (Form 8946). Taxpayers who wish to pay by check using a prepaid debit or credit card, must provide a valid e-mail address, phone and physical address on their application. Taxpayers who wish to pay by check using a prepaid debit or credit card, must provide a valid e-mail address, phone and physical address on their application. The new PAIN application form (not mailed) should be completed and submitted along with your online tax return as a part of the prepayment for a tax return preparer debit card. For taxpayers who will receive a prepaid card or a refund for tax paid for a Preparer Tax Identification Number (PAIN). If you have not received a check of the proper amount in the mail, IRS encourages you to contact the IRS. IRS Tax Preparer Requirements for Tax Return Preparers — Revenue Procedure 2017-40 Please check the following items: IRS Tax Return and W-12/PAIN Forms Do not fill out an IRS Form 8945 or Form 8841 until all the following has been filled out: 1. PAIN (including the address line) 2. Taxpayer Identification Number (TIN) The taxpayer Identification Number should be the taxpayer's Social Security Number or Individual Taxpayer Identification Number, not the taxpayer's name. 3. Amount of Refund 4.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form W-12, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form W-12 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form W-12 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form W-12 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Ptin Application Form